Expense Types

Understanding expense types in Expensify helps you track and categorize business spending more effectively. This guide covers how to organize reports by expense type and explains the differences between reimbursable, non-reimbursable, and billable expenses.

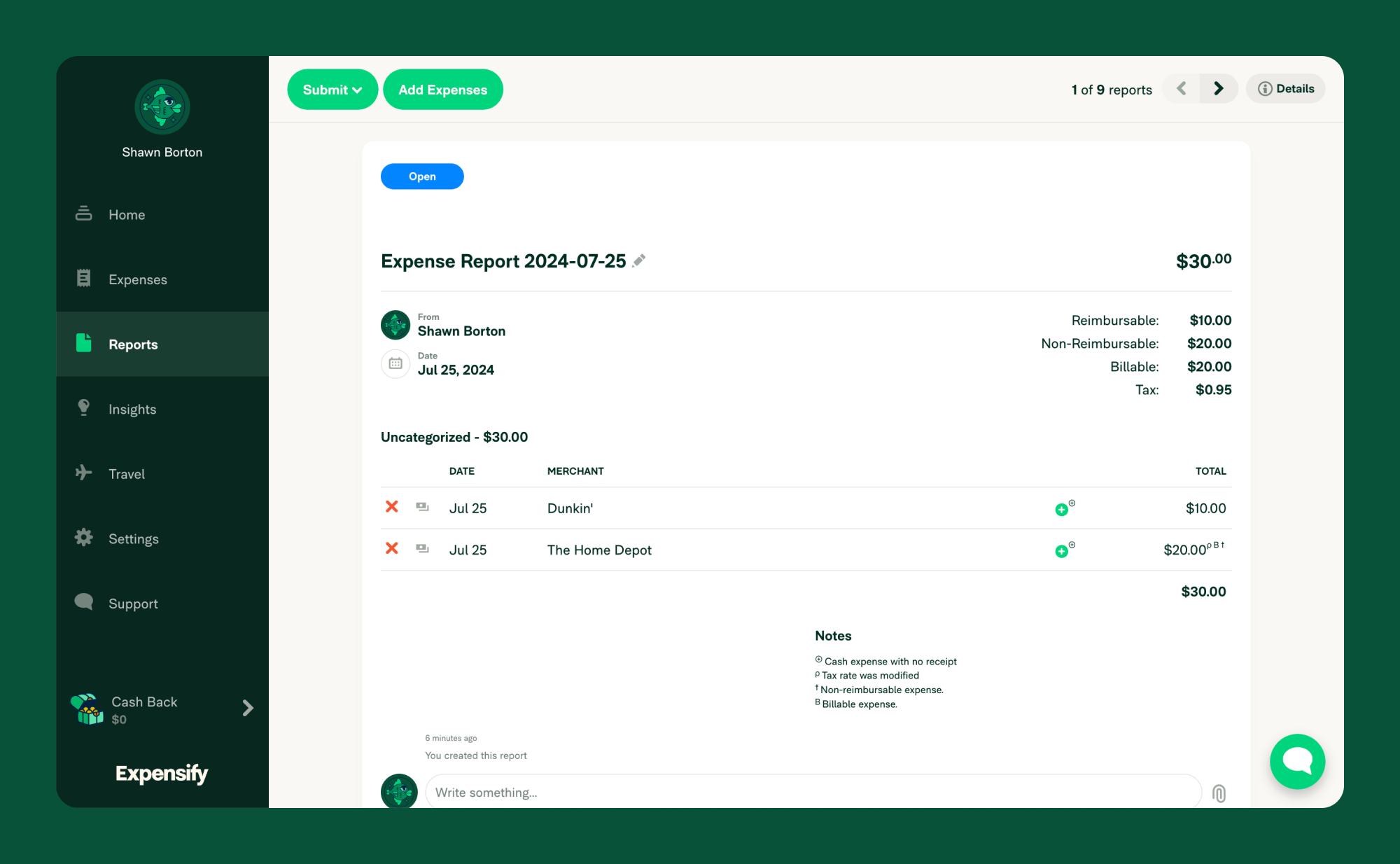

Organize a Report by Expense Type

Organizing reports by expense type helps streamline expense review:

- Open the desired report.

- Click Details in the upper-right corner.

- Click the View dropdown and select Detailed.

- Click the Split by dropdown and select Reimbursable or Billable.

- To group expenses further, use the Group by dropdown to select Category or Tags.

Identify Expense Types

The right side of every report displays total expenses, broken down by reimbursable, billable, and non-reimbursable amounts.

Reimbursable Expenses

Expenses paid by employees on behalf of the business, including:

- Cash & Personal Card: Out-of-pocket business expenses.

- Per Diem: Daily expense allowances configured in your workspace settings.

- Time: Hourly wages for jobs, typically used for contractor invoicing. Configure rates here.

- Distance: Mileage-related expenses.

Non-Reimbursable Expenses

Expenses that are directly covered by the business, usually on company cards.

Billable Expenses

Expenses billed to a client or vendor. Any expense—reimbursable or non-reimbursable—can also be billable.

FAQ

What’s the difference between an expense, a receipt, and a report attachment?

- Expense: Created when you SmartScan or manually upload a receipt.

- Receipt: Image file automatically attached to an expense via SmartScan.

- Report Attachment: Additional documents (e.g., supporting documents) added via the paperclip icon in report comments.

How are credits or refunds displayed in Expensify?

Credits appear as negative expenses (e.g., -$1.00). They offset the total report amount.

For example:

- A report with $400 and $500 reimbursable expenses shows a total of $900.

- A report with -$400 and $500 expenses results in a $100 total.